The Budget Reconciliation Bill: How Could It Change Family Tax and Estate Planning?

The Budget Reconciliation Bill (the Bill) aims to reach several lofty goals, which means it comes with a high price tag. While we had hoped to see some resolution, the legislation is still in negotiations. The Infrastructure Bill passed the House, and President Biden signed it into law on November 15th, yet Congress continues to debate the repayment details of the Budget Reconciliation Bill’s provisions. Uncertainty makes tax and estate planning more challenging; and, even though the legislation is still subject to change, there are proposed provisions that individuals and families should start thinking about as they begin year-end tax and estate planning.

Individual Tax Rates

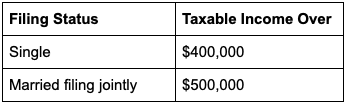

The proposed top combined rate on ordinary income is 43.4%, which is a 39.6% marginal tax plus a 3.8% Net Investment Income Tax (NIIT). This top marginal rate (39.6%) would apply to:

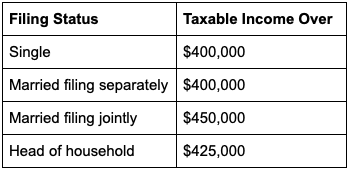

The §1411 NIIT would cover net investment income derived in the ordinary course of a trade or business for trusts and estates:

High-income earners would be subject to a High-income surtax equal to 3% of their modified AGI (MAGI) in excess of $5 million. The surtax would apply to MAGI in excess of $2.5 million for a married individual filing separately and MAGI in excess of $100,000 for an estate or trust.

The maximum allowable qualified business income deduction under §199A would be:

The §461(l) limitation on excess business losses would be amended to disallow excess business losses permanently for noncorporate taxpayers.

Retirement Accounts

If the total worth of an individual’s IRA and defined contribution retirement accounts exceeds $10 million at the end of the prior tax year, additional contributions to a traditional IRA or ROTH for a tax period would be limited to:

Based on the same taxable income thresholds listed directly above, Roth conversions for both IRAs and employer-sponsored plans would be eliminated, and the requirements for required minimum distributions (RMDs) would change.

Gifting Assets

Currently, the unified lifetime gift and estate tax exemption is $11.7 million for individuals and $23.4 million for married couples. Any amounts over the exemption are taxed at a 40% rate.

Some taxpayers, depending on the value of their assets, may benefit from making large gifts now. We could see a reversion to the same gift and estate tax exemption amounts in place in 2009, when the lifetime gift tax exclusion was $1 million and the estate tax exemption was $3.5 million. A 5% increase in the top tax rate has also been proposed, which would increase the rate to 45%.

Proposed increases to capital gains tax could increase taxes on your estate and for your beneficiaries. Proposed legislation would repeal the “step-up” of income tax basis for property that transfers at death and impose a “deemed realization” of capital gains at death.

Under the budget bill proposal, the tax rate on capital gains would increase to 25%. The proposal includes a transition rule, which would allow qualifying gains and losses recognized before September 13, 2021, to be taxed at the current rate of 20%. The transition rule also includes qualifying gains and losses recognized after that date if the transaction was contractually documented and entered into before September 13th.

Contact Livingston & Haynes

This bill is not finalized, so we’ll continue to watch its evolution as it makes its way through Congress. The team at L&H advises individuals and their families on potential factors that could affect their financial health, such as existing and new regulatory requirements, the effects of the COVID-19 crisis, and best practices and concerns for their particular situation. I want to help you and your family thrive. If you’d like to talk about your tax and estate planning strategy, contact us today.

Wendi Haynes, CPA, specializes in accounting, tax, and consulting services for affluent individuals and families. She also provides accounting and attest, tax, and business consulting services for nonprofit organizations and works extensively with a wide array of businesses, focusing on the real estate and retail industries. Wendi has been with Livingston & Haynes for more than 30 years and serves as the firm’s Managing Partner and Quality Control Partner.